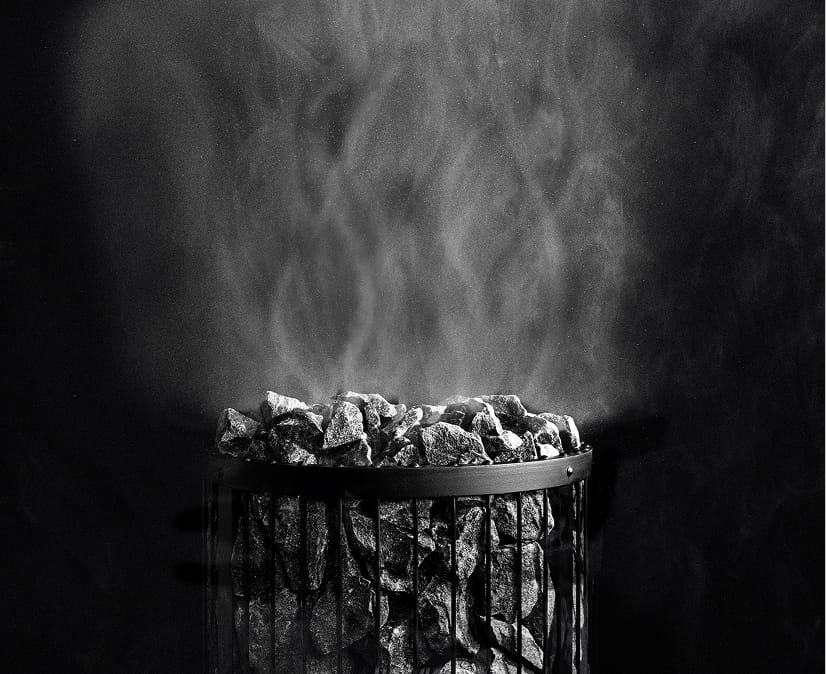

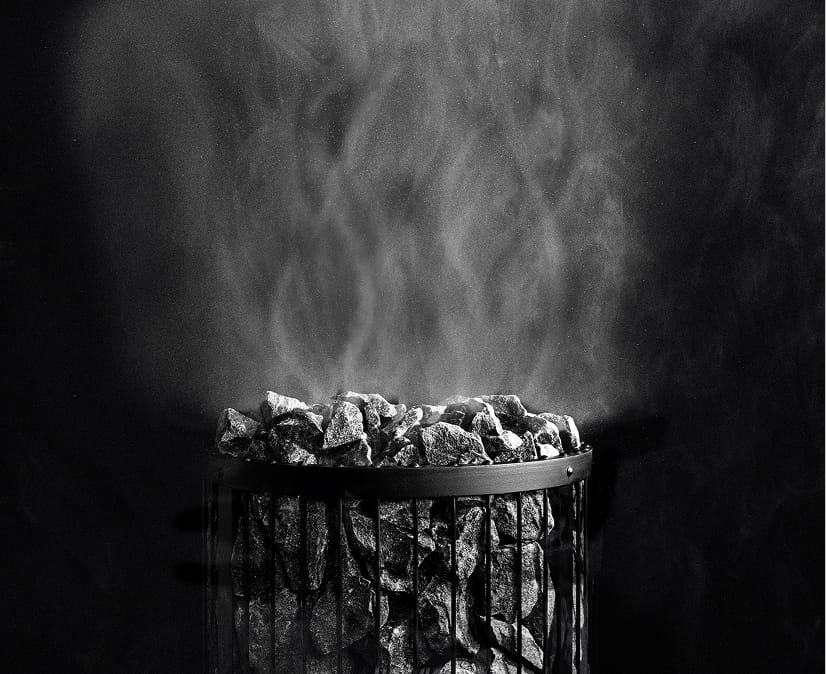

Markets and operating environment

The global sauna market is approximately EUR 3.5 billion in value, and Harvia has the leading position in the market.

The global sauna market is approximately EUR 3.5 billion in value, and Harvia has the leading position in the market.

The global sauna market is approximately EUR 3.5 billion in value. According to Harvia’s estimate, there are some 18 million saunas in the world. The total market value is driven by both the growing installed base of saunas as well as the significant aftermarket for saunas and sauna heaters.

The clear majority of the global installed sauna base is in Europe with Finland, Germany and Russia being the countries with most saunas. Traditional saunas make up most of the sauna market globally and especially in Europe, whereas infrared and steam saunas form a significant part of the market especially in North America and Asia.

Harvia’s management estimates that during the next five years, the global sauna market will grow faster than its historical average annual rate of 5%, supported by the increasing awareness of sauna and its health benefits.

Harvia has the leading position in the global sauna market. According to the management’s estimate, Harvia’s share of the sauna market has increased during the last few years. In 2024, Harvia’s share of the sauna market was estimated to be approximately 5%. The company’s share of the sauna heater and sauna component market is estimated to be over 20%.

Historically, the sauna market has grown annually by an average of 5% and has witnessed some seasonality with slightly stronger demand in the early and late part of the year and lower demand during the summer months. However, the market growth and seasonality have varied: for example, during the exceptional demand growth during the COVID-19 pandemic, seasonality could hardly be witnessed.

The sauna market development also varies significantly by region. For example, the market growth in the United States has exceeded the global historical average for the past several years, but in many key European markets, the market size is still below the pandemic peak level.

In the short term, market growth can be impacted by developments in macroeconomic conditions, trade policies and geopolitical tensions, but the overall long-term outlook and drivers of the market growth remain unchanged.

In Europe, the sauna market demand is largely driven by the need to replace sauna heaters regularly, which increases the resilience of the sauna market in economic downturns. In addition to the key European countries, the United States is one of the largest sauna markets, but there the market size and growth is driven primarily by the increasing installed base of saunas. The increase in the popularity of sauna, low but increasing sauna penetration, and resilient high-end demand continue to support market growth in the emerging sauna markets outside Europe.